Media & IP

Business

Growth Strategy

Launched in 2016 as the new future of TV, ABEMA serves as the core of our audience attraction strategy. Leveraging the Group's synergy, we are focusing on strengthening IP content with high affinity, particularly anime. While the Media & IP business has achieved a milestone by turning profitable for the first time in a decade, we remain committed to expanding our portfolio centered on ABEMA to establish a high-margin business model.

ABEMA as Traffic Engine

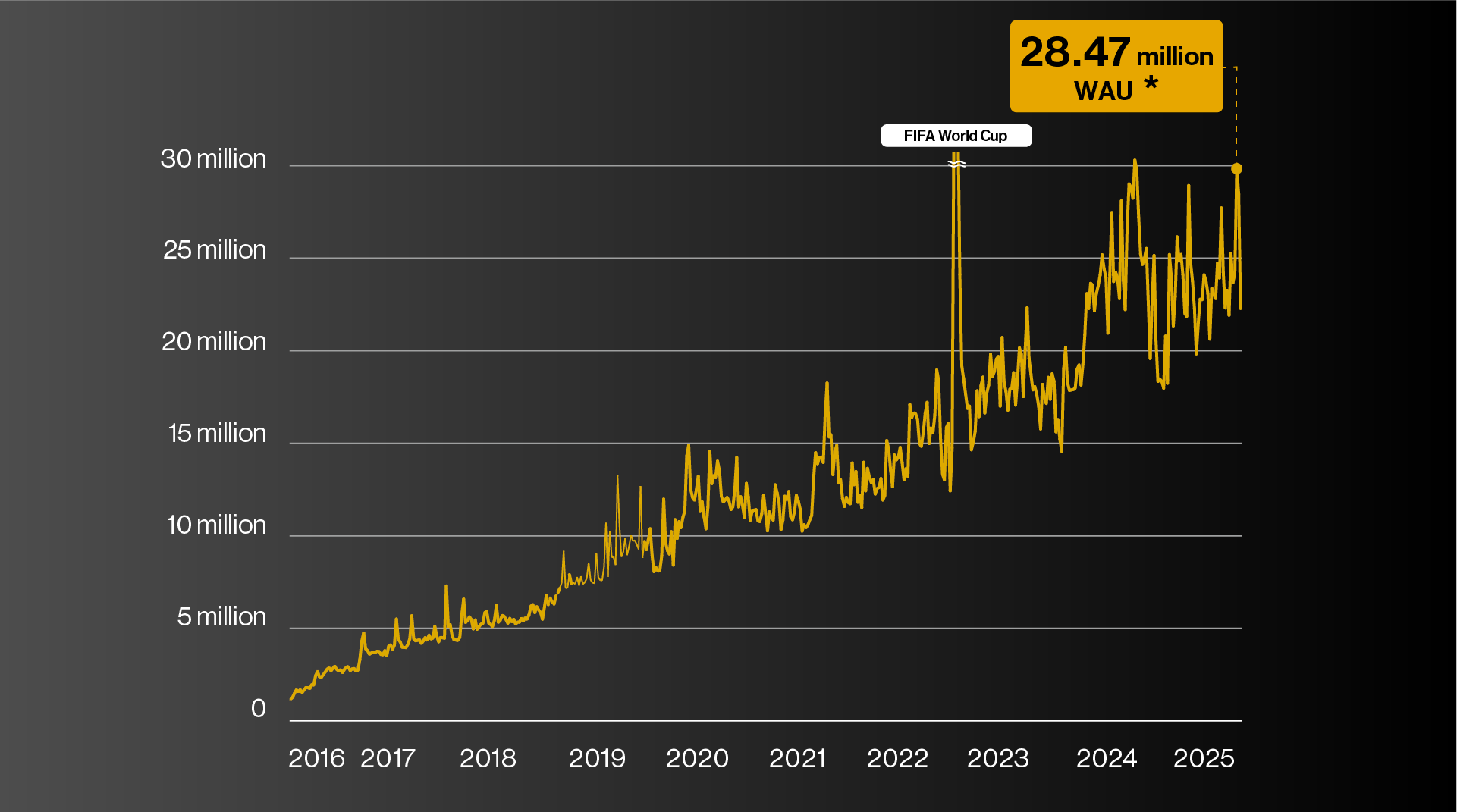

Marking its 10th year, ABEMA has continued to invest aggressively in content production and procurement, enhancing its presence as a video platform. Today, driven by popular sports, anime, news, and hit original programming, we maintain a robust weekly active users (WAU) exceeding 28 million.

Changes in ABEMA WAU

- *

- Weekly viewers recorded from Sept. 22, 2025 to Sept. 28, 2025

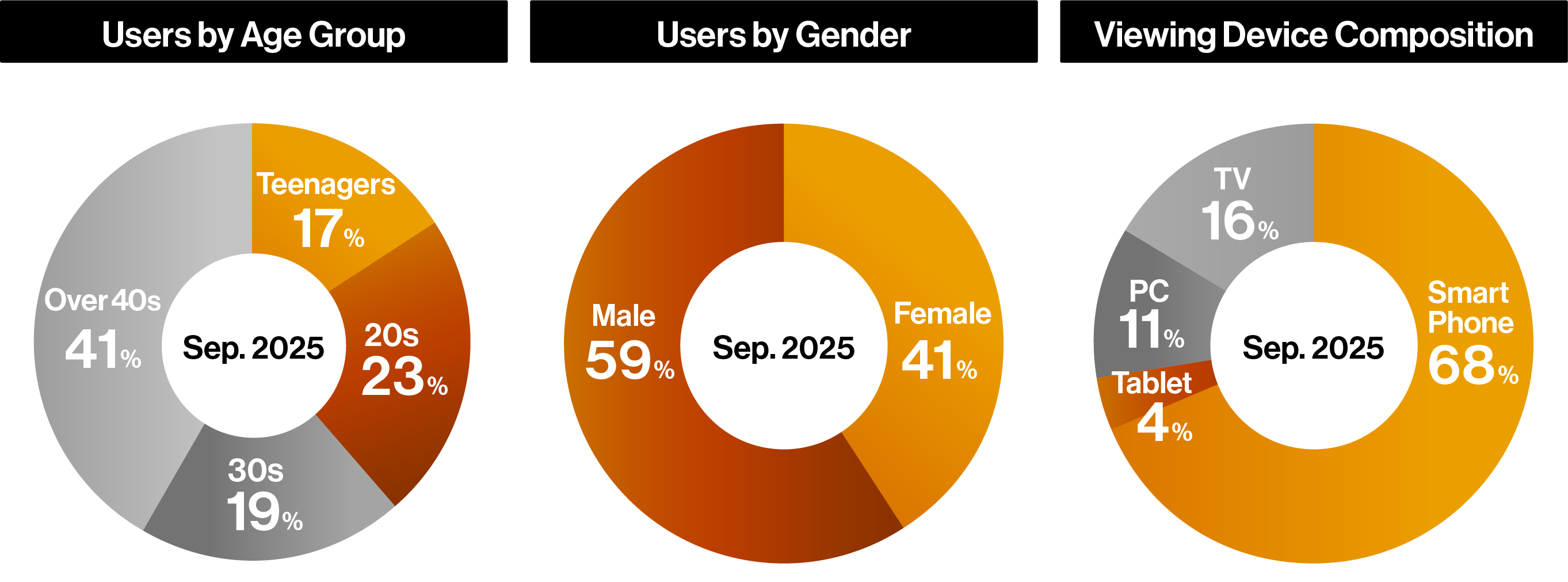

One of ABEMA's characteristics is that approximately 60% of its user base is under 30, a uniquely younger demographic that is difficult to reach through TV networks or other media.

ABEMA User Demographics

The growth of ABEMA is attributed to its distinctiveness and diverse content lineup. We have built trust as a media platform through our 24-hour news channel, which functions as an information infrastructure during disasters, and sports broadcasts such as "Major League Baseball (MLB)" and Grand Sumo tournaments. Meanwhile, our original programs serve as a traffic engine, captivating entertainment-savvy audiences.

Our track record of high-quality original programs is extensive: dating reality shows popular with Gen Z, variety shows recognized by the ATP Award and HBF Prize, and drama that secured the first-ever Grand Prize at the Asian Television Awards for Japanese media. Consequently, we boast the highest volume of original episodes* among all Japan-based video streaming services.

Validating our unique strategy, we became the first to win the Leading FAST Service in Japan 2024 at the World Business Outlook Awards 2024. As subscription costs rise, global interest in Free Ad-supported Streaming TV (FAST) is growing. This accolade cements ABEMA's status as the leader of the Japanese FAST market.

- *

- In-house research as of October 2024

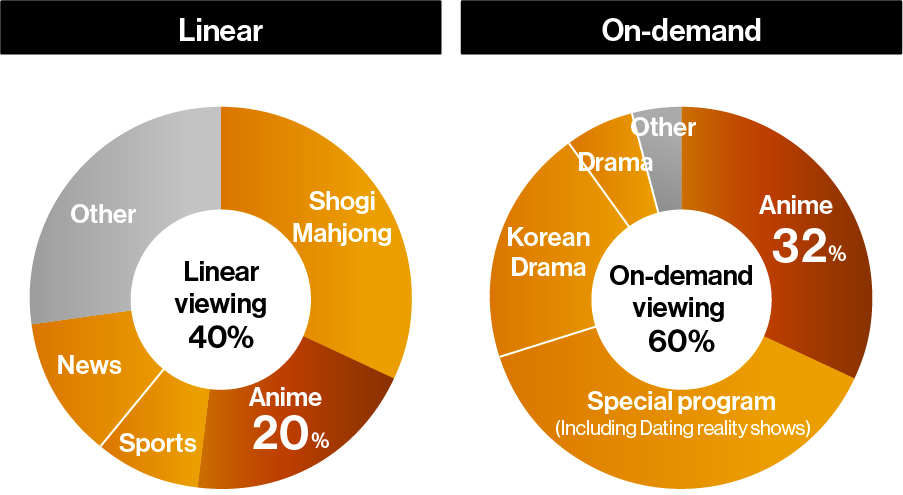

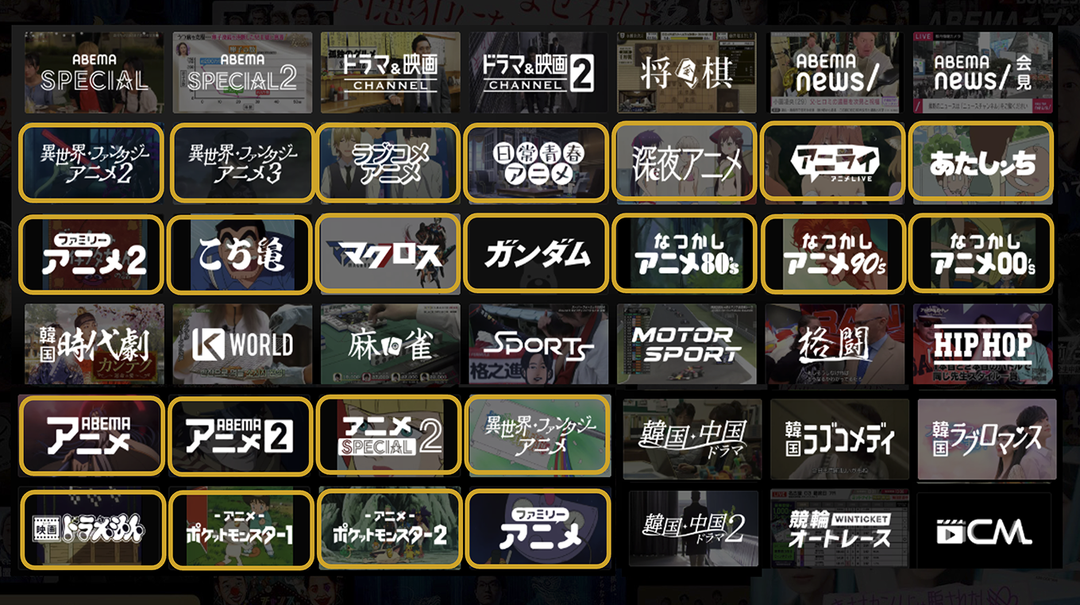

Moving forward, the cornerstone of our global expansion and IP business is anime. Currently, anime-related channels account for half of our approximately 40 total channels, establishing a characteristic foundation for anime viewership.

ABEMA Viewing Time Ratio

- *

- Period: July - Sept. 2025

List of ABEMA Channels

- *

- As of March 2025

Pioneering Global Markets through Anime

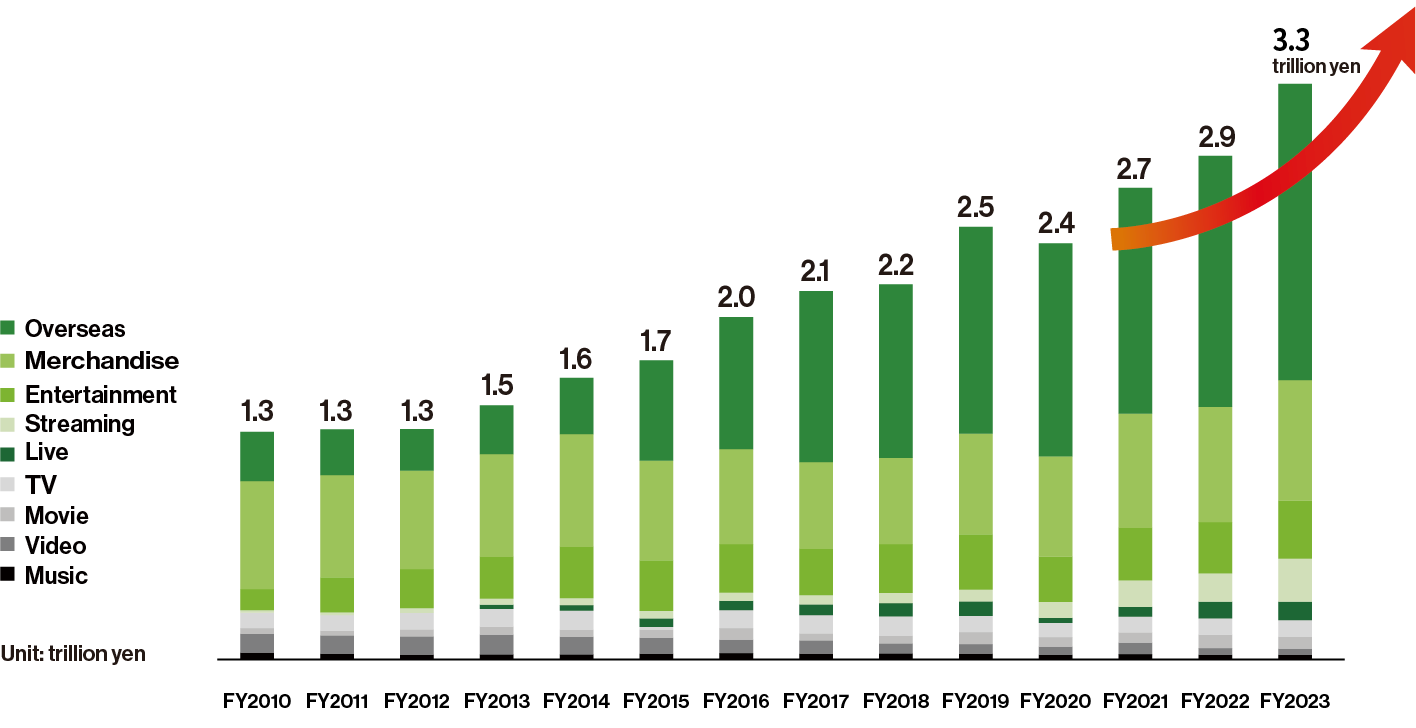

Japan's content industry has grown into a key industry, with export values now exceeding those of major sectors such as steel and semiconductors*1. In particular, the anime market has seen remarkable growth, reaching a record high of 3.3 trillion yen*2 in 2023, with the overseas market surpassing the domestic market for the first time. We anticipate this growth will continue, with the market expected to double in scale to over 6.2 trillion yen*3 by 2033. Moreover, with the Japanese government targeting a total content export value of 20 trillion yen by 2033*4, the anime market is positioned as a primary driver of this national growth strategy.

Japan Anime Industry Market Size

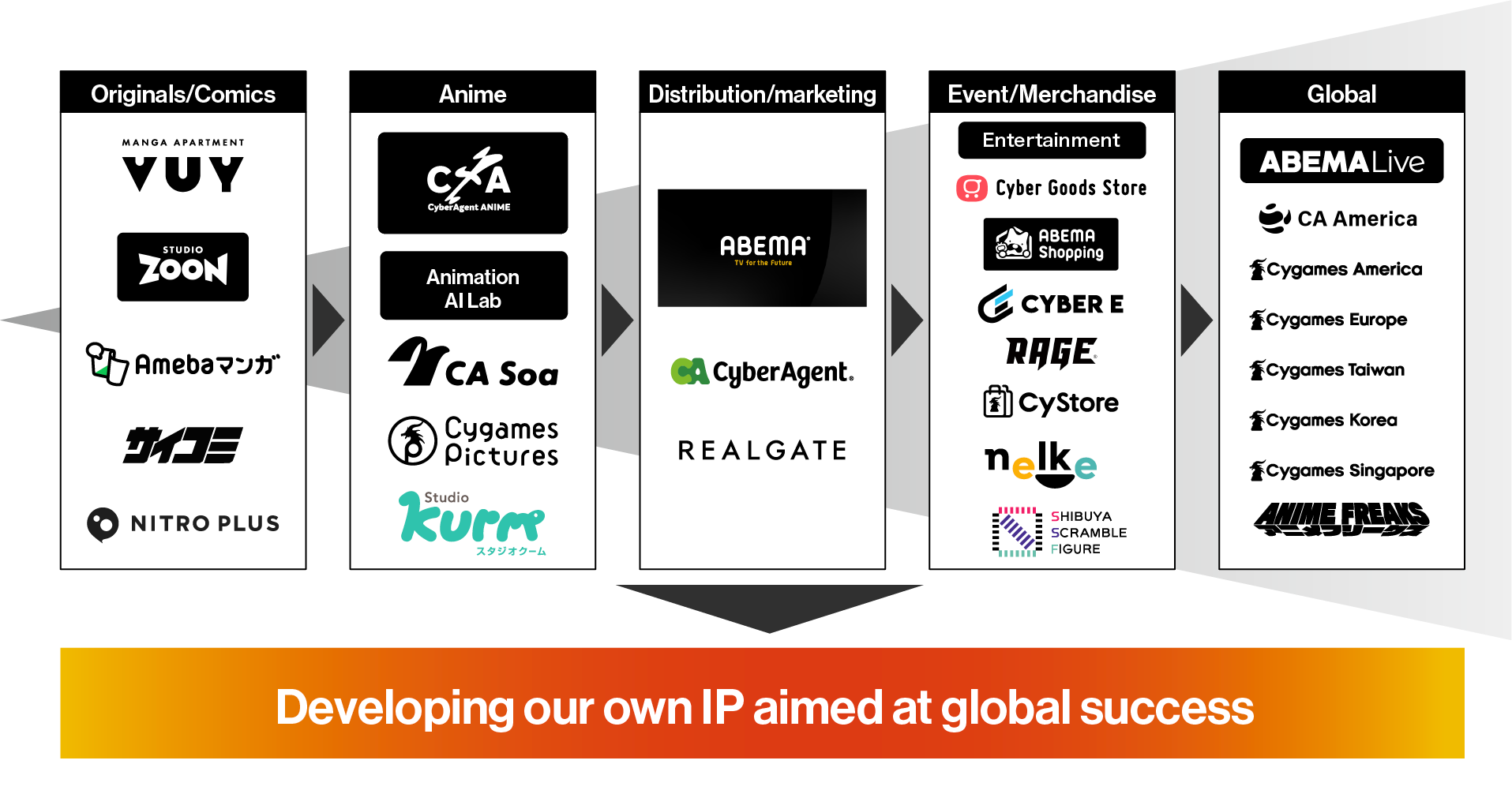

Seizing this vast opportunity, CyberAgent entered the anime sector a decade ago and has gradually built a comprehensive IP ecosystem. We have cultivated deep relationships within the industry through strategic investments and ABEMA-led marketing support. The establishment of the Anime & IP Business Division in 2024 marked a pivotal expansion. Respecting industry heritage, we have established a vertically integrated framework that enables us not only to invest but also to actively lead IP development.

Our growth strategy now pivots on two axes: Maximizing the value of invested IP and creating original IP. To address this strategy, we are intensifying our involvement in production committees while also dedicating ourselves to generating new IP with global appeal.

- *1

- METI, Research on Infrastructure for Global Content Expansion, June 2025

- *2

- Japan Anime Industry Market Size: The Association of Japanese Animations, Anime Industry Report 2024, January 2025

- *3

- Expected anime industry market size in 2033: Calculated the proportion of anime based on the target figures for 2033 in the Intellectual Property Strategic Program 2024, published by the Intellectual Property Strategy Headquarters led by the Prime Minister, in June 2024.

- *4

- Export value of content industry: Intellectual Property Strategy Headquarters led by the Prime Minister, Intellectual Property Strategic Program 2025, June 2025

From IP Creation to Global Hits

Domains of the Group

We have engineered an end-to-end ecosystem covering the entire IP lifecycle—from original creation to production and multi-faceted monetization. This system features group companies with respective expertise.

Nitroplus Co., Ltd., for example, has a wide range of achievements, including Touken Ranbu, and handles IP creation. Nelke Planning Co., Ltd., a leading company in 2.5D musicals, handles stage and live performances. BABEL LABEL Inc., led by Michihito Fujii—a winner of the Japan Academy Award for Best Director—handles live-action films. These companies play a central role in this system. We have strengthened our capabilities in anime production, which functions as a core. Alongside CygamesPictures, known for its high-quality works, we established CA Soa and Studio Kurm in 2025.

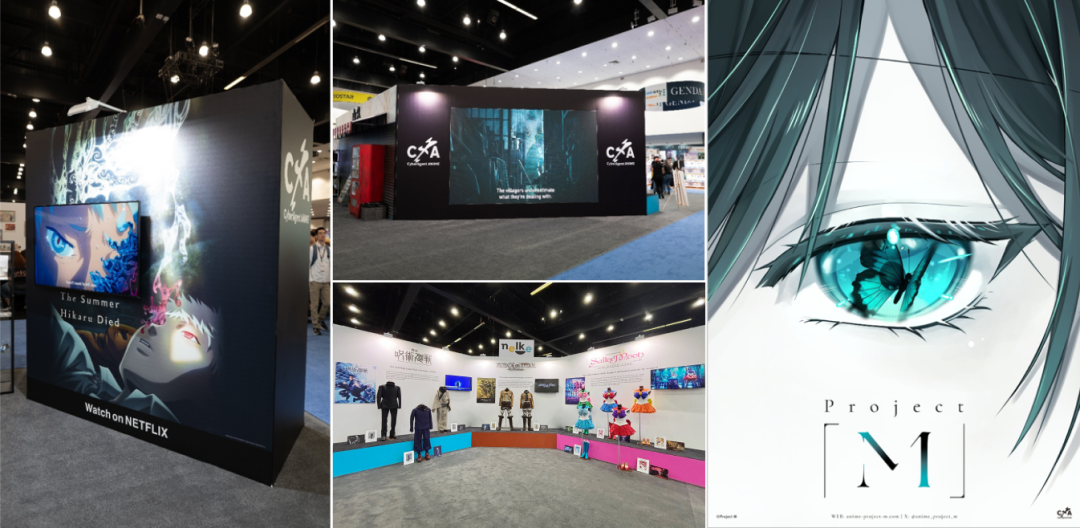

A prime example utilizing this structure is the TV anime The Summer Hikaru Died. Co-managed with KADOKAWA CORPORATION, this series was animated by CygamesPictures. It achieved immediate success upon its July 2025 debut, ranking #1 on ABEMA*1 and #2 on Netflix*2. Due to this positive response, the second season has already been greenlit. Furthermore, a stage adaptation by Nelke Planning is scheduled for January 2026, thereby creating a virtuous cycle in which the Group's collective strength maximizes IP value.

- *1

- ABEMA Weekly Anime Ranking for the periods of July 7–13 and July 14–20, 2025

- *2

- Ranked 2nd in Netflix Weekly Top 10 (Series) in Japan (Week of July 7, 2025)

The root of this system is the presence of creators. Addressing the industry-wide shortage of creators, we uphold the philosophy of Creators First. We focus on establishing an unconventional compensation framework and creating environments where creators can immerse themselves in their work. We also actively invest in promising yet untapped talent through initiatives such as manga artist training at MANGA APARTMENT VUY and collaboration with HAL College of Technology & Design.

We have also revitalized CyberAgent America to spearhead global anime marketing, launching the multilingual anime news hub ANIME FREAKS. Through strategic alliances with MyAnimeList, X Corp., Weibo, and KANA, we will strengthen our overseas anime marketing by localizing communication designs and promotions for each target country.

To cultivate a global fanbase, we are increasing our presence at major international conventions. At Anime Expo 2025 in Los Angeles, our booth showcased key titles like The Summer Hikaru Died. We also unveiled Project M, a new animation project launched in July 2025, which captivated attendees with mysterious visuals that sparked imagination.

Through these comprehensive initiatives, we are strengthening the IP business to realize a sustainable, high-margin business model.

【Copyrights】

Hyena of Love: ©AbemaTV, Inc.

I fell in Love Today: ©AbemaTV, Inc.

Scandal Eve: ©AbemaTV, Inc.

The Summer Hikaru Died: © Mokumokuren/KADOKAWA • The Summer Hikaru Died

Production Committee

"Pretty Guardian Sailor Moon" The Super Live: © Naoko Takeuchi・PNP / "Pretty

Guardian Sailor Moon" The Super Live Production Committee 2025

Jujutsu Kaisen The Stage: ©Gege Akutami/SHUEISHA,JUJUTSU KAISEN the stage

ATTACK on TITAN: The Musical: ©I・K/AMPC2024

Project M: ©Project M

Related Articles